Improving Payment Solutions for Small Businesses

Designing a simple, efficient payment processing solution to simplify transactions for Teamshares' network companies.

Background

Teamshares supported small businesses in their transition to employee ownership. The company acquired businesses from retiring owners, provided modern financial tools, and enabled employees to become part-owners over time. Many of these businesses operated with outdated systems, especially when it came to accepting payments.

The Problem

Financial leads at these businesses often relied on paper checks or paid high fees for credit card processing. Checks were slow and labor-intensive. Credit card fees were costly. Both options created friction and made payment collection inefficient.

Approach

I led user research to understand responsibilities, workflows, and constraints across our network. Two insights guided our approach:

Financial leads were stretched thin. They needed tools that were easy to adopt and required minimal ongoing maintenance.

Customers often had limited technical confidence. The payment experience needed to be clear, simple, and intuitive.

From there, we defined a narrow set of core use cases, validated early concepts with users, and partnered closely with product and engineering to stay disciplined on scope and deliver quickly.

Solution

We built a simple, affordable payment processing feature designed to improve cash flow and reduce friction:

Streamlined onboarding: A pre-built default template required minimal setup. Businesses could add light branding by uploading a logo to increase trust with customers.

Configurable payment links: Businesses could create one-time or reusable links and choose fixed or flexible payment amounts—covering common needs without unnecessary complexity.

Tight scope: We grounded decisions in research, avoided feature creep, and optimized for speed to launch.

Outcome

The feature launched on time within a six-week window. Involving users early helped us prioritize confidently and move fast. After release, multiple businesses adopted the tool, and several began transitioning away from checks and high-fee credit card solutions—resulting in faster payment cycles and reduced administrative overhead.

Key Screens

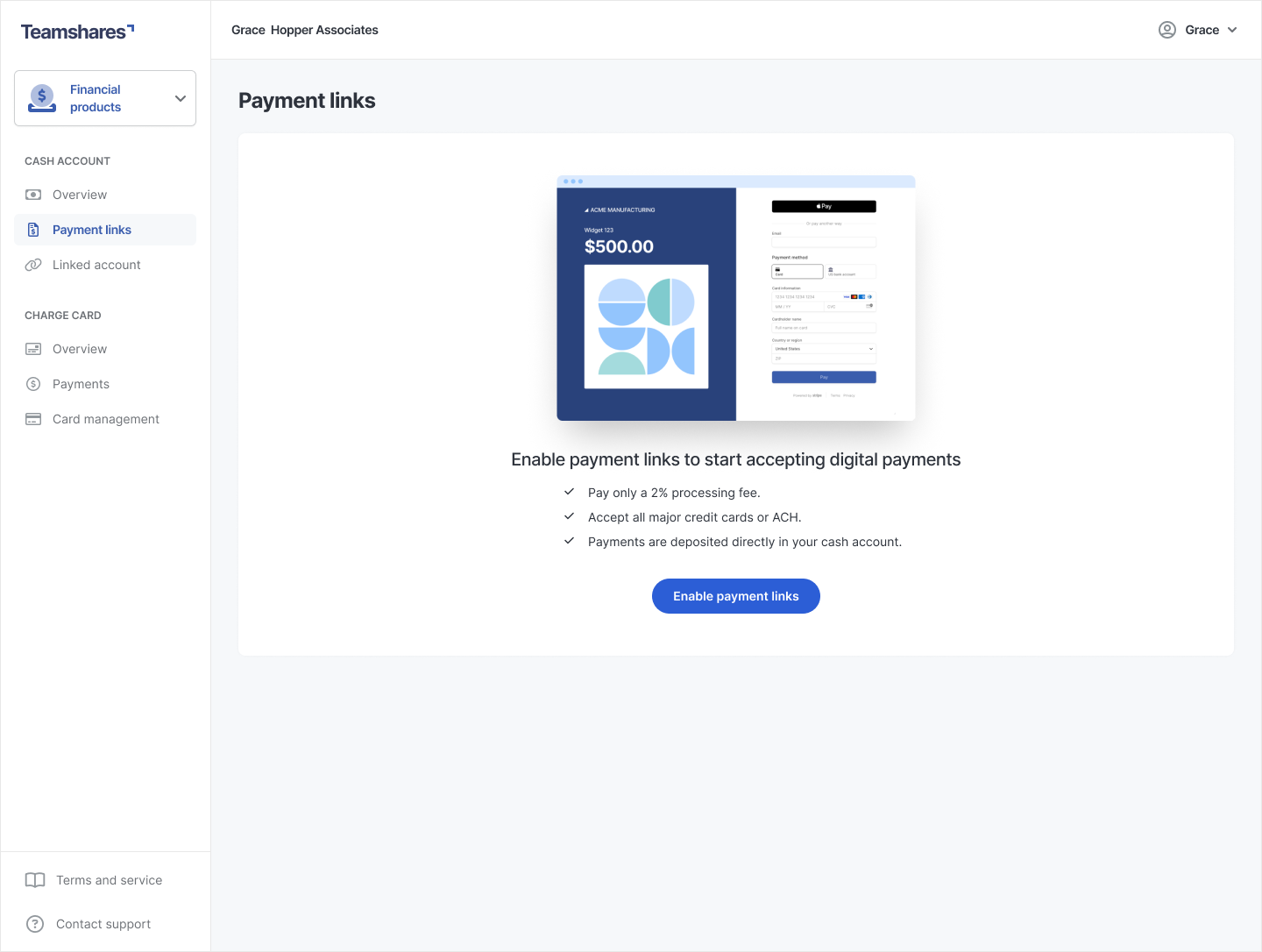

Marketing page for a new Payment Link feature, explaining the benefits to network companies.

Onboarding step where companies could add their company name and logo.

Payment Link creation page where users could customize individual payment links.

Company view where admins can manage payment links and view for individual links.

Example of a payment link page network companies could use to collect payments.